In his latest commentary about recent developments in the Russian economy, Sergey Aleksashenko, nonresident senior fellow at the Brookings Institution, weighs on the recent data released by Rosstat, noting signs of the economy finally “bottoming out” and wondering at the Bank of Russia’s stubborn policy of keeping the key rate intact.

While Bank of Russia continues to postpone lowering the country's key rate, head of the Federal Reserve System Janet Yellen (above) made a decision to raise the U.S. key rate, which was implemented on March 15, 2017. Photo: Bao Dandan, Xinhua / TASS.

Russia Is Not Portugal

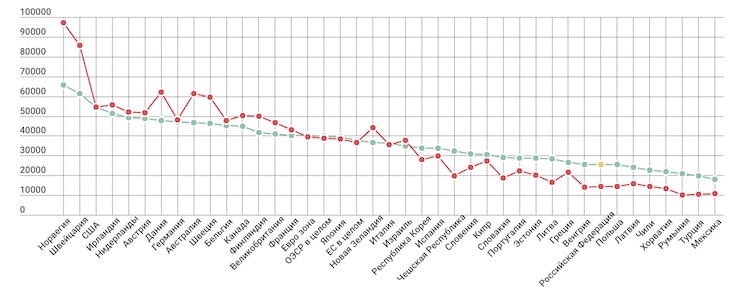

Rosstat has published, jointly with the European Union and the Organization for Economic Cooperation and Development (OECD), its correlation of GDP with purchasing power parity (PPP) for 2014, which so far is the Russian economy’s “peak.” This data shows that at the end of the year, Russia’s volume of GDP in relation to PPP per capita was 88.4 percent of Portugal’s.

The “good news” is that Russia is still ahead of Poland, as well as all of the Balkan countries (with the exception of Slovenia). The “bad news” is that the results of the correlation clearly indicate that there is no raw materials dependency, as it is often claimed in Russia,—just look at the rankings of Norway, Canada, and Australia, countries in which the share and importance of their raw materials sectors are comparable to Russia’s.

Chart 1. Level of GDP and GDP in relation to PPP per capita in 2014 ($/person)

Source: Rosstat (the yellow dot shows Russia's GDP level).

Among the technical details, I would call attention to the fact that Russia still has a colossal gap between the current exchange rate of the ruble and the exchange rate in relation to PPP: in 2014, the former was greater by a factor of 1.78 (the market exchange rate of the dollar was 37.97 rubles, and the exchange rate in relation to PPP was 21.28 rubles). This speaks to the fact that the ruble has huge potential for real strengthening over the long term. The exhaustion of this gap, judging from the chart, takes place on the level of nominal GDP per capita in the range of $35,000-40,000.

Investment Is Ready for Growth

Rosstat has published its first assessment of investment in basic capital for 2016 and tells us that it has decreased by only 0.9 percent. At the same time, Rosstat affirms that the share of investment that went toward construction of buildings and structures has actually increased. Well, well. This must mean we have finally reached the “bottom.” But we’ll see whether there will be growth soon enough.

What More Does the Central Bank Need?

Also, in Rosstat’s estimate, in February, consumer prices grew by only 0.22 percent, which is a historic low for this month (previously the lowest measure of February inflation was 0.37 percent and occurred in 2012). Central Bank of Russia experts say that their estimate of trend inflation in February also continued to fall. But so far, that is insufficient reason for the Bank of Russia to decide to lower the key rate. I can’t imagine what more information the bank leadership wants before deciding to lower the rate.

Moreover, in the latest edition of the central bank’s bulletin “What Trends Are Saying,” a new threat was articulated—which may well be sounded by the bank’s leadership, if at its next meeting (on March 24), the board of directors doesn’t decide to lower the key rate. Namely, that of more rapid inflation, to be felt most strongly in the low-income segments of the population. In general, a stronger inflation pressure on the poor is common in the world and is not a phenomenon unique to Russia or to these particular circumstances. Inflation always hits the poor harder, and therefore the fight against inflation is always and everywhere the most reliable means of raising the living standards of the population.

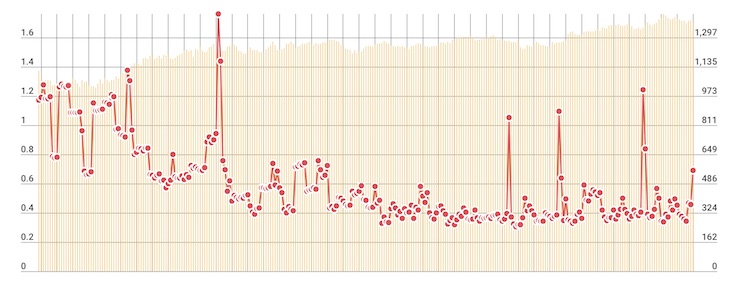

As for the key interest rate, the Bank of Russia is conducting a very strange policy, in my view, increasing the volume of deposits attracted from banks (from the level of 300 billion rubles at the beginning of the summer to 600-650 billion rubles in December of last year), and maintaining a deposit rate at a level close to 10 percent per annum. By last December, the price of oil had already increased and vacillated in the range of $45-50/barrel, but the members of OPEC still had not agreed on a reduction in the volume of oil production.

For me the rapid strengthening of the ruble’s exchange rate in the second half of last year, which occurred despite all seasonal factors and the country’s unsteady current account balance, is undoubtedly the result of a strong flow of speculative capital, which focused on carry-trade operations, from those who couldn’t pass up the chance to earn high interest in Russia. Nine to ten percent per annum for one-day or one-week deposits in the Bank of Russia—just try to find something better and safer.

Chart 2. Volume of deposits of Russian banks placed in the Bank of Russia, and exchange rate of the ruble to the dollar, 2016–2017

Source: Bank of Russia

FRS in Сounter-Phase

While the Bank of Russia feverishly maintains its key rate at an unreasonably high level, which lowers the demand for credit and suppresses economic activity, the U.S. Federal Reserve System apparently is going on the warpath—to be precise, on a trajectory of gradually raising the interest rate. By the end of the year one should expected the rate to increase two or three times, which will lead to a strengthening of the dollar and the gradual raising of the cost of borrowing on world markets.

Everything Is Clear with Banking Supervision

The story of Tatfondbank’s revoked license and the size of the holes in its balance sheet (more than 120 billion rubles) tells us that no improvements in bank supervision in the Bank of Russia can be seen. The saddest thing in this story is not that one of the top 50 banks in Russia by size went bust, or that the size of the capital deficiency exceeded all reasonable measures, but the fact that the bank’s capital deficit was declared a year ago. While the agencies of the Russian government and of Tatarstan squabbled over whether to save the bank, and if so, at whose expense, the size of the holes in the bank’s balance more than doubled.

I won’t be surprised if the depositors of Tatfondbank who lost their assets will attempt to sue the Bank of Russia, accusing it of inaction and negligent discharge of its duties. I am not certain they will succeed in winning such a case, but I believe they very well might.

An Unprecedented Situation with Mortgages

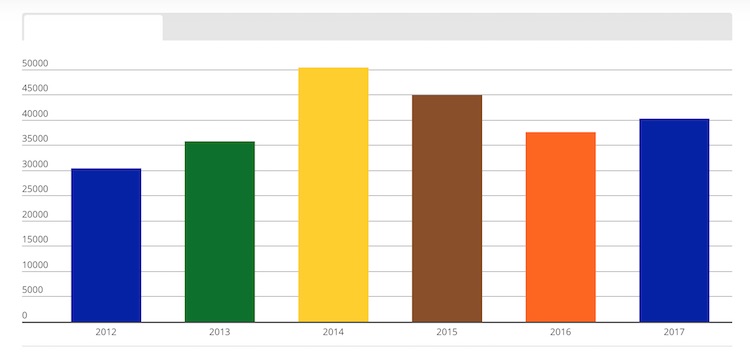

January is not the best month to engage in prognostications about the future, if you’re looking at the data about the issuance of mortgage credits. A large number of holidays and the holiday mood among a considerable percentage of well-off Russians (those who can afford to take out a mortgage) mean the quantity of mortgages issued in this month is one and a half times less than in any of the subsequent ten months, and more than two times less than in December.

However, I would call attention to two things: First, the quantity of credits issued in January of this year is noticeably less than the levels in 2014 and 2015 and only slightly exceeds last year’s level. Secondly, although the overall sum of credits issued in January exceeded 71 billion rubles, the amount of accumulated debt on mortgage credits (in rubles) lessened by the end of January. This has never before happened in Russian history.

So far I am not inclined to consider this the public’s reaction to the government’s refusal to support the program of interest rate subsidies, but the public undoubtedly understands very well that in real terms, the present interest rate on mortgages is abnormally high.

Chart 3. Issuance of new mortgage credits in Russia in January, 2012–2017

Source: Bank of Russia

Automobiles Are Not in Demand

Statistics for sales of new passenger cars for February were, to put it mildly, bleak: a falloff of 4 percent compared to February of the previous year. Therefore, it would be premature to speak of even a slow restoration of consumer activity in the more financially secure half of the Russian population.

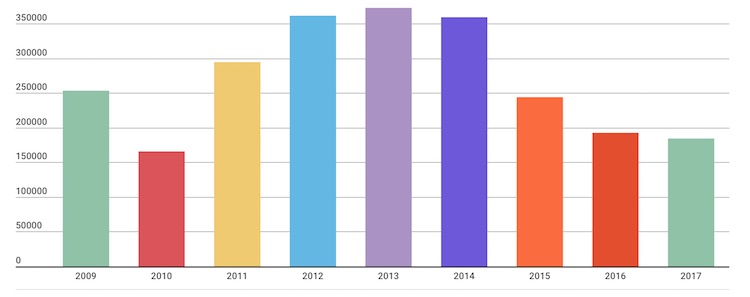

Chart 4. Sales of new passenger cars in Russia in January–February, 2009–2017

Source: Association of European Business

The English translation of the original article was abridged and edited for clarity.